Which stock is the best and the worst? We went into this with the mindset “what would be best to hold for 2025+.” Chart reviews are based off the daily and weekly. Each of these have a fundamental rating, chart rating and then of course some of my own speculation on the companies. The results surprised even me…Disney being one of my favorite companies, it stacked up less favorably than some.

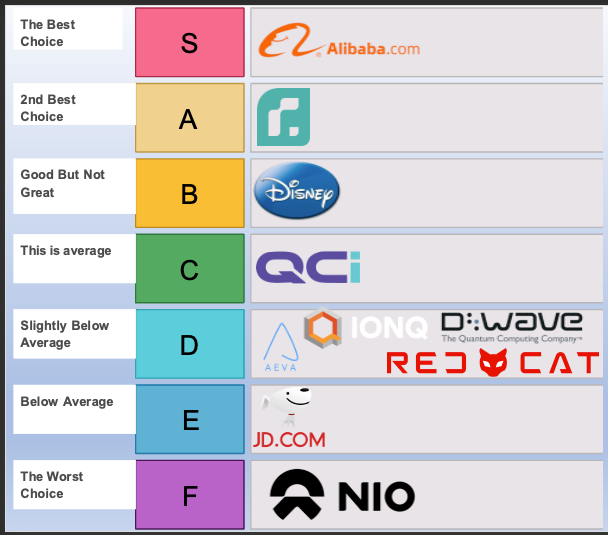

These are all subscriber requested stock reviews, so do consider joining! Next week this will be subscriber only reviews. Alibaba, JD, Disney, D-Wave, Quantum Computing, Rigetti, Aeva Technologies, Redcat, Nio and IonQ were the 10 companies rated. Here are the notes version and final ranking at the end:

The first thing we needed to note was the potential volatility, simply because comparing something like Disney, with a market cap of $196B is obviously going to perform very differently than something like Aeva Technologies, with a market cap of $237M. To be clear, a stock with a huge market cap can be just as risky as one with a tiny market cap, the trajectory of profits or losses is just typically faster for the smaller market cap asset. You have equal chance of realizing a 30% profit, or loss, with either…just one will give you the answer faster. This issue is resolved by evaluating confidence in longevity…ie: which businesses are generating cash flow, paying shareholders and is not on the brink of financial collapse.

Additionally…the first thing I noted, is NONE of these stocks have re-achieved there all time highs. RedCat once traded at over $68,400 per share, back in the early 2000’s. A current price of $10.83 would result in a gain of ~617,228%. Do I think that will happen? Absolutely not. Do I think money and profits can be realized? Sure. Redcat Holdings is a drone technology company, and I think it has great potential for a more substantial run, those kind of prices would the market cap in the multi-trillions. Think like 50 Nvidia’s or something for context. It’s just unrealistic.

Regardless of that ridiculous estimate, I still like to see what has the MOST percent potential. Remember, we dont care about PRICE, we care about PERCENT CHANGE, as that is what impacts our portfolio most. This is why I often make fun of the bitcoin community….yes, Bitcoin is a BIG PRICE….but the percent profitability has been declining every single year. They are waiting longer to make less.

Long story short: there is potential in all of these. Don’t shrug off IONQ because it is only a 46% potential. Fund managers would commit serious crimes for returns like that. Additionally, IonQ recently made its all time high, where as many of them have been down for months or years. This could indicate continued momentum…and at a $8.3B market cap, it may just be starting, having IPO’ed in 2021.

The next step, was identifying which companies believed in their own business. Now this is not a perfect solution, do note that stock prices can stay down regardless of holders. However, its a good indication of which companies have dumped their shares…particularly for the smaller market cap stocks. Aeva Technologies came in first, with insiders holding 41% of the shares. NIO was the worst company, with 0% held by insiders. This indicates to me the stock may have just been a “cash grab” for the company. NIO IPO’ed in 2018, had a massive surge in 2021, and has since only went down….all through 2023 and 2024. Because of this fact, NIO automatically gets placed at the bottom of our rankings. (Note….this is why you have never heard of me speak about NIO on social media). JD is similar, with only .01% closely held…however considering China’s economy, BRICS and their stimulus coming along, I dont want to automatically put it at the bottom. Disney disappointed me with only .07%….however thinking more deeply about it, recall Disney has been around for more than a century. Most the original holders are dead 💀

Now we are down to 9, and let me start by asking you a simple question. Disney has 1.81B total shares and a stock price of $108. Nio is similar in that is has 1.92B total shares, yet has a stock price of $4. In theory, they should have similar stock price ranges due to the total shares available. Yet, they aren’t even close. So is Disney overvalued? Or is Nio undervalued? Your answer may differ from mine. But what I do know is that Disney has positive earnings and cash flow, whereas Nio has negative earnings and cash flow. Maybe they are both fairly valued…🤔

What I do know is that we can rank them from “overvalued” to “undervalued” with: relative valuation = price/total shares. Now if you ask 10 people, or 10 fund managers in a room, if they thought IonQ is overvalued, which it ranked the most overvalued, you would get 10 different answers. That is just the nature of the market. But here is what I do know…for an asset to reach an all time high, or a 52 week high, or have generally good performance…it needs to consistently be considered “over valued”. This trend is our friend. Nio is ranked most undervalued…but the market may have put it there for good reason.

JD is 2nd worst, and now we can add this to our ranking. My initial thoughts is China stimulus occurring….so I will maintain BABA for the time being. Additionally, when some more substantial breakouts, JD and BABA could both gravitate to the top quickly. But for the context of this specific, time based review, we can cut JD.

Cash flow and earnings will eliminate a lot of these now. But let’s make somethings clear first. Many of these companies are newer. It is extremely common that new companies operate in the red for several years, before they turn profitable. When evaluating the cash flow and earning aspect, I was seeing who was trending in the right direction. Maybe a company had negative cash flow, but each quarter, or each year, they were improving their numbers. This increases the probabilities that the company will survive, and turn profitable. We finally had some of the small caps that had positive earnings, Quantum Computing and Rigetti both had positive trending earnings. Their cash flow was negative…but not deteriorating further unlike some of their competition. JD, Disney were also improving earnings, and Alibaba stagnant. These were annotated simply with: 1 = improving, 0 = stagnant, -1 = worsening.

We can eliminate 4 more companies with this approach. And be aware, just because something is rated low, does not mean that the fundamentals cannot change over time. Or that the stock price cannot go up. However, at this specific time, we are trying to find what is the strongest fundamentally. That said, we can eliminate Aeva Technologies, Redcat, D-Wave and IonQ. Nio was already bottom of the barrel.

We are left with Disney, Alibaba, Rigetti and Quantum Computing. Lets start with quantum computing, and eliminate either RGTI or QUBT. We are at a stage where we can focus on chart reviews and focusing on strength. This one is pretty simple…Quantum Computing had a huge spike in 2009. However, hardly any price action in 2021, what I would consider the easiest market ever for a stock price to go up. It also hardly went up in 2023 (to be fair, few small or mid cap stocks did). However, to go from a stock price in the hundreds, down to $10 (or less)…could be an indirect way of the market telling us there is a problem. To be fair, the volume has drastically ticked up. So I dont want to say “its bad”…things could change rapidly. However, choosing between RGTI and QUBT comes down simply to stability. Additionally, if QUBT is running…so will RGTI (most likely). I just simply have a preference for RGTI chart stability, even considering how young of a asset it is.

Because of this, we can put QUBT in the next tier up, and keep Rigetti for further review. Do note, that even though its labeled “this is average”….its not average, by any means. I still wouldn’t touch it with a 10 foot pole. Now lets stack up Disney vs. Alibaba from a chart perspective.

Now recall, this is what I think is best. Imagine someone is holding a 🔫 to my head, and telling me I must invest everything I have into a company…or two companies. Disney has had long term growth, continuous stock price climbing, positive earnings, positive cash flow. Alibaba is slightly newer, yet has experienced much of the same. Both charts went up from 2016 to late 2021. They have nearly identical market caps of ~$195B. China is providing stimulus. Alibaba ships worldwide, yet Disney has a world wide audience. This is probably the TOUGHEST one to split apart due to their similarity. And because of this, I like to think….which one has the most % potential. Recall Disney is 87.9% away from its all time high, whereas Alibaba is 289% away from its all time high. Alibaba has far more percent potential.

Additionally…I am not left, nor right. But we have to address how politics may impact each of these. Strong conservatism is moving into every single branch of the U.S. goverment; Whitehouse, congress, senate, etc. As much as I love Disney…as a company…they have leaned heavily left for several years. And considering growing conservative agendas, we have to account that they, Disney, may be negatively impacted. We consistently see Diversity, Equity and Inclusion (DEI) groups absolving themselves. Disney may face public or even official backlash due to this. Do I think it will impact them long term? Absolutely not, Disney is a global brand, and the political polarization between Republicans and Democrats is solely a United States thing. Kids in Asia or Europe do not really care about the “woke” agenda or Christian values on the flip side of that. Regardless, they may experience some back lash.

Because of the % potential, and the political atmosphere, Alibaba wins this competition.

We are down to Rigetti and Alibaba. We have reviewed the fundamentals, the chart structures and now must make a tough decision. We were able to eliminate several of these companies on fundamentals alone. And let me be crystal clear on this aspect: I am NOT a Quantum Computing expert. Whether this technology takes over or not, is a speculation I do not have the skillset or experience to even guess on.

I asked ChatGPT “Do you think quantum computing will take over?” and think it provided a well rounded sensible answer.

This is my personal opinion, and is speculative…ie…not based on any facts. My opinion is that we will continue to see Quantum Computing grow. Something I contemplate as a conspiracy theory is whether or not it will be used to by governments to destroy Bitcoin and Crypto….total hypothetical thought of mine, I do not know the validity of those articles I have read online. Regardless, even though it has alot of use…what is the widespread adoption of it going to be like? Minimal in my opinion. It appears to be a very niche produce, which makes me wonder if the $2.64B market cap is at or near a top. Will it reach NVDA size one day? Maybe, but I just dont see it. I could just be an old fart 👴 in that thought. However…regardless of what happens with quantum computers….businesses, governments, people will forever buy goods and services. Something everyone has done since the beginning of time, and will likely continue doing well after I am gone. Because of this, Alibaba wins this round of Winning Pick Wednesday.

I want to reiterate, one last time….ANY of these stocks can go up, or go down. Additionally, Rigetti has the most % potential to offer due to low market cap…though it would have to find a new all time high. I am in none of these stocks, as I would wait for a setup to form with each of them. Rigetti has wild whiplash in both directions. Alibaba I would like for price to get back above its 200 day moving average to even consider it, at $84.32. I am monitoring Alibaba, and will let you know when I decide to get in.

Thanks for stopping by, and let me know your thoughts. Do you like this format? How would you have changed the rankings?

All of this is my thoughts and opinions, and is not financial recommendations. Consult a fund manager for investment advice. 92% of fund managers underperform the S&P 500 😂

If you would like to have your stock considered for next weeks review, feel free to join the chat and let me know. Ill add it to my little red book 📕

Share this post