After watching the video, here are some examples of blow off tops…which preceded major meltdowns in their respective markets. If you have questions, feel free to ask in the chat, or leave a comment!

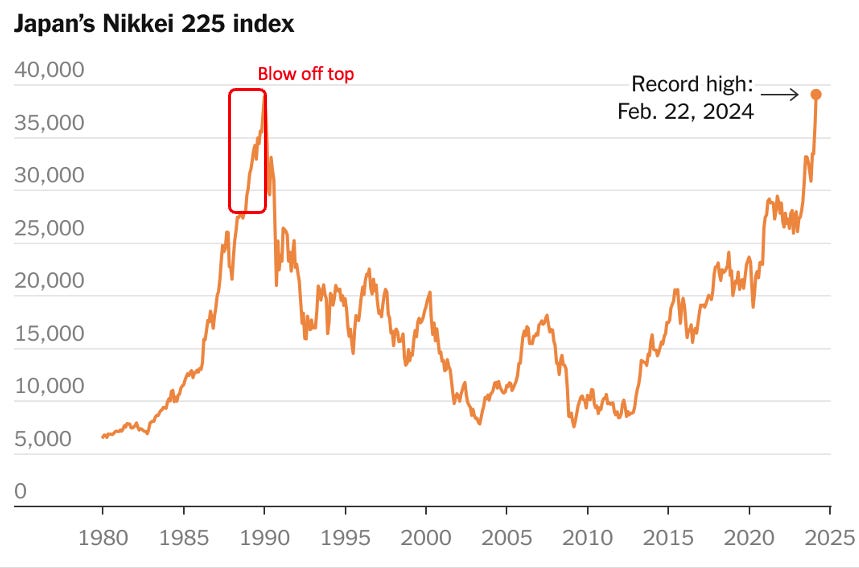

Nikkei 225 - Japan 1989

Nikkei rose +300% from 1985 to December 1989, with a steep final surge.

Hit an all-time high of ~39,000 in late ’89

Collapsed over -80%

This is my favorite example and many economic features of Japan 1989 are similar to the United States today.

NASDAQ Composite – Dot-Com Bubble (2000)

NASDAQ soared +500% from 1995 to March 2000.

Final leg was nearly vertical in late 1999/early 2000.

Fell -78% by late 2002.

Shanghai Composite – China (2007)

Shanghai Comp surged +500% in less than 2 years, peaking in October 2007.

Crashed -72% by the end of 2008.

🧠 Common Patterns in These Blow-Offs:

Rapid acceleration in the final months

Retail participation surging at the top

Sharp, violent reversal with no support underneath

Years (sometimes decades) to recover

If you’ve found value here — and want real-time setups, trade breakdowns, and no-BS market insight — consider subscribing.

Share this post