Back in November, I presented a deep dive research article on Affirm…which you are welcome to view below. Affirm is one of my favorite companies and we made about 34% in the span of a month. I am eagerly awaiting a re-entry signal (and I will post when I get that signal).

That said…I get dozens of research requests per day. Above is what I see most often. Feel free to ping me in the chat if you would like me to add yours for voting, and I will update the poll (please no random microcap, new IPOs…they’re too unpredictable at that stage). Please let me know which one you would like a full DEEP dive review on.

There is no guarantees that the companies will get bright reviews. I will also make a video on it in case you dont want to read. But I will state where I think entries should be, and give you my best estimates for target prices. Reviews will be based on the 2025 year ahead.

Affirm Deep Dive Below ⬇️

(This is to give you an idea of the write up…this one has already ran, for now).

Bitcoin won’t replace Banks. Affirm Will.

The “Buy now, pay later” is something I have kept in the back of my mind for a long time. I recall thinking the first time I came across this term, I thought “as inflation worsens for consumers, this service will get used more and more.”

Affirm IPO’ed in January 2021. I typically avoid IPO’s just due to the massive amount of insider transactions that occur during launch, and a few months after (many shareholders have locked shares and wait to sell). It peaked November 2021, and then sold off to oblivion, reaching $8.63.

Some quick notes about Affirm:

• Transaction based platform: Provides loans at point of sale

o Pay-pal has a “buy now, pay later” feature, but is not the industry leader. Affirm focuses on transactional loans, whereas Pay-pal is more peer to peer.

o Afterpay, Klarna, Zip and Sezzle are competitors...but they do not have “first mover advantage” or near the amount of stability internationally that Affirm does.

Affirm holds some of the loans, but also sells a portion of the loan to banks and investors. So if all of a sudden everyone stopped paying their loans (unlikely), Affirm would not take the full blunt of pain. Banks would.

Holds some cash reserves, but mostly for operational purposes. Unlike banks.

Total Addressable Market (TAM)

This is where the investor in me gets excited. When you think of a bitcoin transaction, both the person and the vendor require bitcoin, a wallet, a seed phrase, a crypto brokerage, and so many etc steps to conduct the transaction. In my humble opinion, mass adoption of this system was never going to happen. It’s too complex (even though it has improved). And no matter what you say, a huge swath of the population will never trust Bitcoin’s volatility for stable payments. Period.

Affirm is simple. Borrow money, and a fixed rate is applied depending on creditworthiness. This sounds similar to a credit card, but a major difference is that credit cards have annual fees, late fees, transaction fees, etc. Affirm is far more simple....and predictable for both investors and consumers.

The total addressable market (TAM)....is, well, everyone. Affirm started in the United States. On November 4th, Affirm officially launched in the UK.

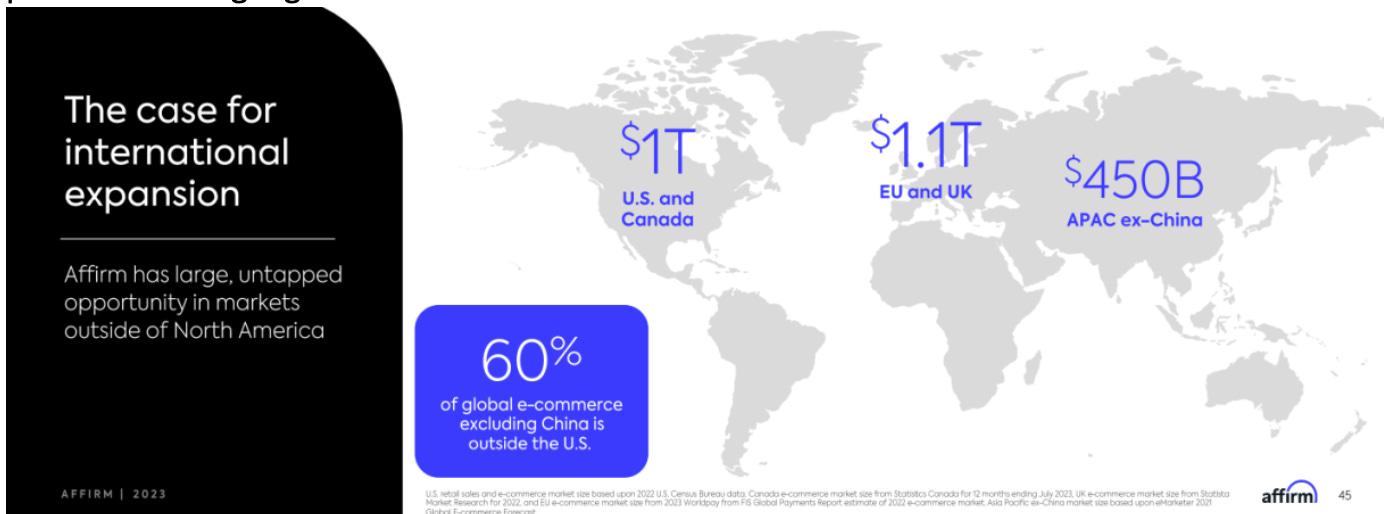

So where else can Affirm expand to besides the United States and the U.K.? Well....everywhere. in fact, they are trying to rapidly expand in more areas. Page 45 of their investor relations presentation highlights this.

Not only can they expand to more countries....they can also expand to different types of vendors. Affirm isn’t just used for purchasing that Peloton you will use for a month and then forget about. They noted on page 15 that their expansion into grocery stores, restaraunts, gas stations and home improvement were expanding rapidly.

Think about every store you ever visit. It could get inside of there relatively easily.

Lets Talk Numbers

Affirm launched in 2012. Its not a “new company”. But it takes several years, and a lot of capital, to build a customer base, trust in transactions, federal regulation compliance, etc. It takes months and years to start seeing the accrual of interest on loans turn a young company from operating in the red to the black (become profitable).

But they have proven that. And now, instead of operating in the millions, they recently just went from operating in the millions, to operating in the billions. The 2025 projects over $3B in

revenue, from their current $2.3B. Their debt levels are increasing, however this was the first year where they had positive cash flow. Remember, this is a loan company, they need debt, and they need to make enough to pay on debt. They are surpassing the cash flow need at this point.

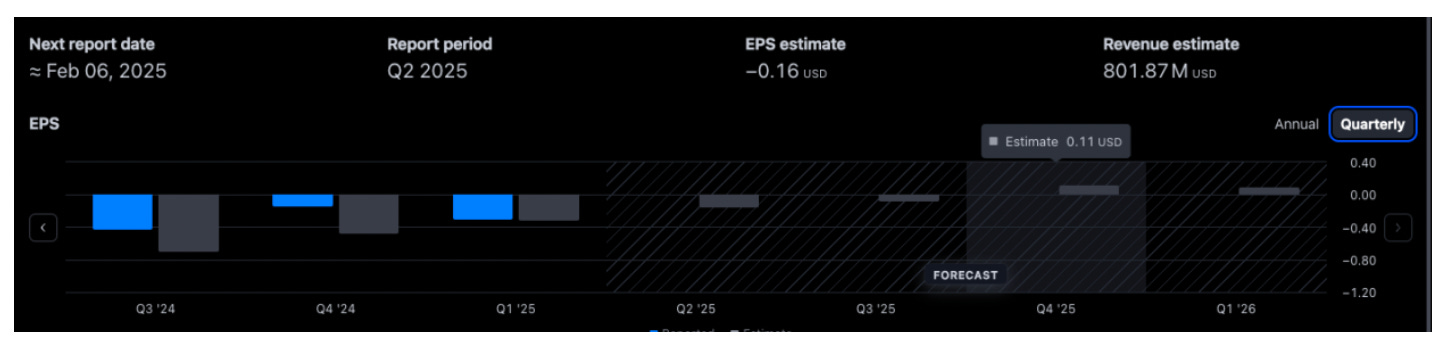

Earnings have been negative...but this to be expected considering the age of the company and its line of business. Projections of earning to turn positive by Q4 2025 (time will tell). Regardless, If you are getting in when the earnings finally do turn positive, you missed the boat. The market is going to front run that earnings expectation.

NVDA hit a $1T market cap when it generated $7B in revenue. Affirm today, has just started to get into the billions, and stands at a $17B market cap. To give you some perspective. I don’t often say something is “cheap”... but I do think it’s a matter of time before the market wakes up and realizes there is a sleeping giant. I feel slimy saying that. But it’s the truth.

The Technicals

Most of the buying (accumulation) occurred on June 2023 and November 2023. The long term holders just got into profit the last month or 2 (lots of variables here). They didn’t accumulate a small cap for a micro sized return. This thing will have a big mark up phase in my humble opinion. Additionally, it tapped the 52 week high....contracted, and is right at its 52 week high

again. This is a prime set up for a big run.

Disclosures

Could the stock crash tomorrow and go to $0. Yes.

Could the macroeconomic environment ruin our bullish narrative: Yes. Could we be the right about Affirm and the stock goes down: Yes.

Anything can happen. Approach at your own peril. I am not responsible for you or your portfolio. I don’t care if you make money or lose money. I accept responsibility for neither. These are just my opinions.

Additionally, I am not concerned with “it went down 5% today or 10% this week”. Shut up. Over the next year, maybe more, I think this has 100s of percent of potential.

Investor presentation link:

https://investors.affirm.com/static-files/d2071372-c9d3-4888-9987-a40315e7228f

goat's cock needed to exchange bitcoin lol... wasn't sure if this was a saying of some sorts so I took a risk and looked it up on google (no incognito mode). First hit was a youtube video titled "Goat With Deformed Penis Finds Perfect Home at a Sanctuary for Disabled Goats." I'll save you all the trouble, this video wasn't that interesting. Honestly, a little more heartwarming than I wanted. Anyways, thanks for coming on this journey with me and thank you Tim for the write-up.