Credo Technology Is Going To The Moon 🌙... But There Is A Twist 🪢

Whether You Invest Or Not... This Article Discusses A Hidden Aspect Investors Often Miss - Cayman Islands

Everyday we run the StockTok Screener, a python script I built that scans 4950 stocks, seeking out the top performing stocks in their early breakout phases. Thus far, it has produced a lot of early winners…sometimes with tickers we would never have even thought of. These are the ones that interest me most, the ones we don’t hear everyone chirping about. And today, CRDO 0.00%↑ was one of those names.

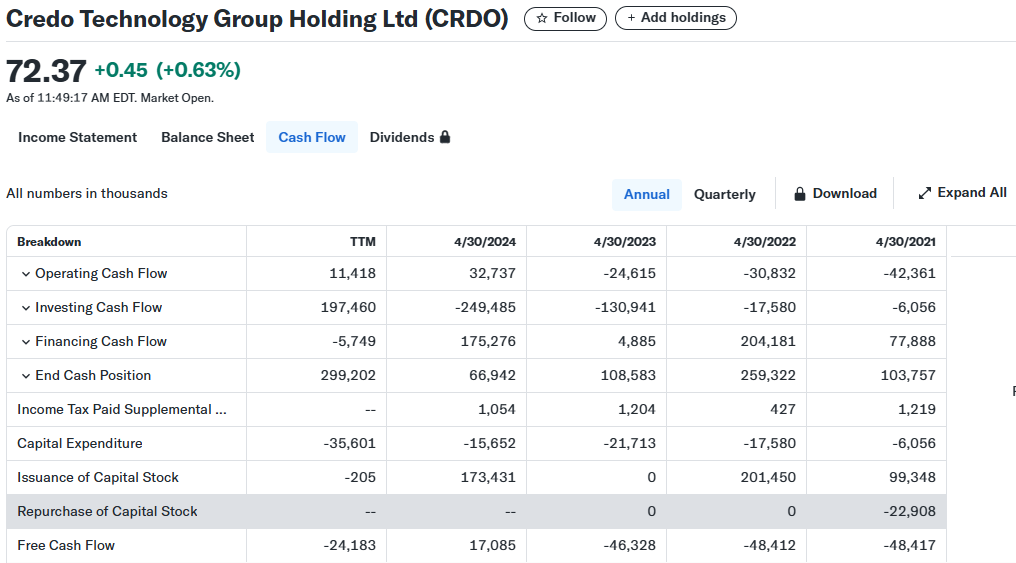

A quick glance…it’s fundamentals appear as an amazing “turn around” company. A turn around company is one that is historically performing terribly, and then, does a turn around, performing wonderfully. Credo Technology Group posted great numbers at their last earnings report, a increase to $.7 EPS and cash flow finally in the positive at $17M annually. Stock price action just broke out. That is great! All the elements we love of a potential big winner.

And thus, I proceed to look more closely. Typing into google: “Credo Technology Group”, an immediate red flag 🚩 pops into my mind when the results appear. Without reading further…can you spot the “red flag”?

If you guessed “Cayman Islands” you are a genius. Congratulations. This was something I learned from the Crypto space…over time in 2020 and 2021, I noticed multiple crypto companies, brokerages, lenders, etc., operating out of the Cayman Islands. Something was fishy. To my discovery, the Cayman Islands are extremely popular to financial schemes because their financial systems are easily exploited for secrecy and regulatory arbitrage. Some basic facts about the financial system there:

No corporate or income tax

Cayman laws protect privacy of account holders and corporations (ie Law Enforcement cannot easily access information)

Ease of incorporation attracts shell companies to be used to hide assets or launder money

Large offshore financial sector. Thousands of investment funds, banks with trillions of dollars in assets, makes finding bad guys a game of “needle in the haystack”

International regulation allows bad actors to circumvent local laws.

Cayman Islands law enforcement is notoriously lackadaisical to investigate schemes

They Cayman Islands have been tied to multiple financial calamities, including but not limited to Enron where multiple shell companies were used); Panama Papers…again, more shell companies. And tax evasion is a constant problem.

I even traveled to the Cayman Islands in search of a very popular crypto, Chainlink. This is a crypto that often gets circle jerked in the crypto communities…yet has never re-achieved former highs, -73% since 2021…not shocking. Chainlink was listed as being in the Cayman Islands, and thus when I visited their address…to my non-existent disbelieve, they were not there. The building secretary had never even heard of them.

The point being…Credo Technology Group may be a legit company…but a Cayman Islands headquarters is a huge red flag to be aware of and I think the odds of it being legit are low.

So why do I think CRDO could still go to the moon? Couple of reasons.

The company IPO’d in February 2022. And though it did go down with the rest of the market, it was not very substantial. This indicates a multi-month and multi- year accumulation phase.

During this accumulation phase…the company had negative cash flow. Why would the stock price NOT be dropping, for a company that is performing so terribly?

3. The company just reported its first positive earnings report. Do I trust Credo Technology Investor Relations Reports? LOL, no, not at all. But when stock price goes up, should this be a pump and dump company…its very uncommon for them to only pump it once. The recent breakout increases the probability of a 2nd run upwards.

Should you invest in this company long term? Absolutely not lol. When we look at Bill Brennan, the CEO and President of the company, we can quickly look at his prior work with Vital Connect and note, that long term success or customer satisfaction is not his priority.

The point of the article: I believe CRDO will have a large run…but will not last forever. Many clear signs this is just a pump and dump…but by managing greed, the pump part can be capitalized on. I once covered a crypto company called Vectorspace AI, VXV. It ran nearly 1000%. And people still lost. The same warnings with CRDO apply. There comes a point you must sell…assuming these speculations are correct (everything in this article is speculation) and we do get a run. What you do with this company and this information, is ultimately up to you. I take no responsibility in your portfolio. At the very least…you know about the Cayman Islands now and to be aware of their reputation for fraud.

These little tid bits of knowledge is what I like. I bought a smaller than normal portion because the earning surprises looked good but seemed volatile. I would never have noticed Cayman Islands.