Bitcoin's Diminishing Returns Even As It Passes Google and Amazon

Bitcoin boasts a big price on the screen...but small percentages 🤏

A candid review of Bitcoin and why investing in this Bloated Pig is a terrible idea…coming from a guy that made significant profits in the Crypto space. If you want to trade it…go for it…but INVEST? Absolutely not!

For more: Timothy’s TikTok | Investing for Beginners | Current Stock Positions | Daily Stock Screener | All Publications

Subscribers get direct access with me Monday to Friday during market hours in the chat, stock reviews and access to the Stock Screener. Subscribe Now.

THIS IS NOT A CRYPTO PITCH…ITS AN INVESTMENT THOUGHT PROCESS

Nor is this a post predicting Bitcoin’s top price…but more so, to think differently as an investor. Notice EVERYONE is watching Bitcoin? Do you think “everyone” is going to get rich? Of course not. So don’t follow “everyone”. Bitcoin wasn’t what set me free financially…Peloton, Ethereum and Hedera Hashgraph did back in 2021. My bet is many of you likely have no idea what Hedera even is (that’s ok!) Those receipts and posts can be seen far back, but the point of this is to get you to stop thinking about “what is big” and to start thinking about “what can grow?”

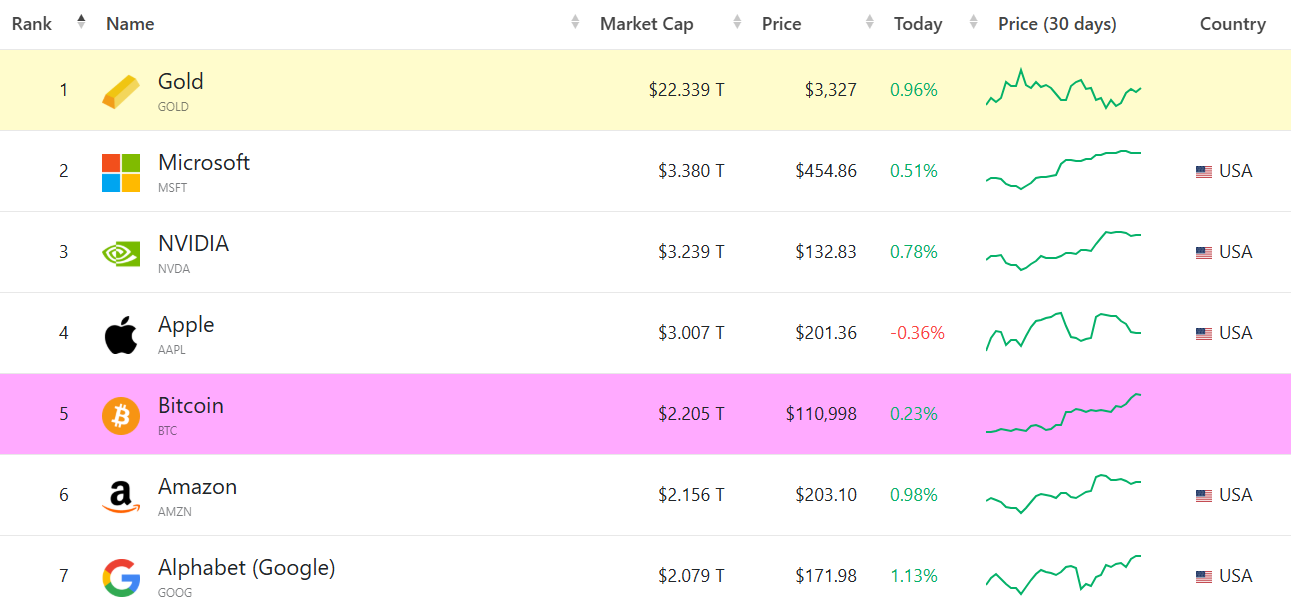

Lets start off with why you never hear me talk about Bitcoin anymore…or Amazon…or Google…or really any asset typically in the trillions of dollars market cap range. Besides the fact that there are already 1000’s of creators circle jerking these tickers, and telling you to hold in 2025 as if they are Warren Buffet in 1962…news alert…that time has passed. The primary reason, is your growth potential is incredibly limited.

Why did we talk about Palantir PLTR 0.00%↑ last year? It had high growth potential. Recently we posted about a company we expect to be The Next Palantir. Why? High growth potential. That is the entire point of an investment portfolio…to grow. And none of us will live forever unfortunately, so we would like it to grow faster than average, especially in this rapid inflationary period!

Let me introduce you to the law of diminishing returns, with a simple example first. You are a strawberry farmer and you want to increase your harvest…i.e., get more strawberries. A good solution is to add some fertilizer to your plants.

If you add a pinch of fertilizer, you may get an additional 2 or 3 strawberries.

If you add 2 pinches of fertilizer, you may get 5 or 6 strawberries.

Add 3 pinches you still only get 6 strawberries.

Add 4 pinches you still only get 6 strawberries…notice you are not increasing your harvest yield.

The same concept applies to investing…where the more money that is thrown at an asset, the less returns you will get.

Now let us look at Bitcoin together. This reduced “harvest” is clearly shown…where the returns are getting smaller…and I will add, the wait times longer. The real winners of Bitcoin were the early investors…that threw a few small pinches of money (fertilizer) at bitcoin. They achieved HUGE returns. They had massive percent change opportunity.

A very simple example, someone that only has $1000 to invest with.

2015

Bob invests $1000 into Bitcoin at $100 a token.

Bitcoin rallies to $19,000

Bob made a profit of $189,000

2022

Bob invests $1000 at $17,000

Bitcoin current price is ~$110,000

Bob made $5,470. Bob did well, but is not making life changing gains. He also spent a lot of time waiting for that smaller profit.

Bob would have had to invest $35,545 dollars at $17,000 a token, to make $189,000. Clearly, that is significantly more risk to an individual’s finances, when one risks, say $1000 or $35k. And this is assuming Bob has impeccable market timing…sorry, I see 575,000 people a day…most do not.

Getting the point? More time. More risked money. For less reward. It just does not make sense. Even if Bitcoin goes to say, $250,000 a token…or even a million (my top estimate has always been $142k since 2021 but take that with a grain of salt)….the amount of time spent waiting for that big number and the relatively small gains, make it not worth it, in my opinion.

Now I know, going and finding the next, early “hot” stock or asset is a bit of work. Sometimes I get asked when I am going to “load the truck” (go full portfolio)…which that day will come…but often times, I don’t feel the need to. A small investment can go a long way.

You have $10,000…and you go find 10 stocks to invest $1000 in each. 5 of those shit the bed and lose -90%. The other 5 however go up 100%. You made $500 in profit, a 5% increase in portfolio equity. If you get say 7 correct at +100% and 3 incorrect at -90%, your portfolio gained $4300 in profit, or 43%.

One may retort “well I could lose in all 10.” It’s true…you could…but that seems to be an issue with how you review and analyze companies. And how you manage risk…Rule 1 in investing, don’t let a small loss become a big loss. Frankly you should never experience a -90% drawdown if you manage your positions…Sorry, not sorry…you deserve it if you allow that to happen to you. Powerful lesson. Trust me, I was once a new investor and learned the hard way too. The market’s a cut throat environment, so forgive my strong words…its to drive a point to you.

I provided very generic numbers and examples for simplicity in understanding. I’m not saying to go YOLO into 10 different stocks or to degenerately gamble meme coins. You may notice that I gradually pick up positions here and there, as I see an opportunity. And sometimes those positions end up being cut (to prevent large losses)…sometimes you will see a position only return a small gain. But other times, throughout the year…you see that stock that just keeps sprinting up…these are the ones that truly change portfolio equity in time. ETH, HBAR and PTON 0.00%↑ did it for me in 2021. The Ruble did it for me in 2022 (along with shorting Terra Luna and Cardano). Roblox RBLX 0.00%↑ Affirm AFRM 0.00%↑ and Alibaba BABA 0.00%↑ the most recent…albeit not “100%” gains…performed well, >20%.

The point of the article: you have to risk it for the biscuit. The investment should not feel “safe” or “popular”….if it does, your upside potential is likely severely limited…potentially dangerous in fact. If the asset is over $2 trillion, I have 0 interest. Bitcoin has went up…but having spoken at conferences and meeting hundreds in the crypto space…the other “wealthy” investors were the ones that were around years ago AND at some point, clicked the sell button. Again…this is not a Bitcoin price prediction, you can make money from it. But you if you are just now looking at it, along with “everyone”….you frankly will never achieve any noticeable changes in your portfolio.

For more: Timothy’s TikTok | Investing for Beginners | Current Stock Positions | Daily Stock Screener | All Publications

Subscribers get direct access with me Monday to Friday during market hours in the chat, stock reviews and access to the Stock Screener. Subscribe Now.