90% Of Traders Fail, And 100% Of Them All Use The Same Indicators...SO DON'T

These are indicators I built, that no one else uses. They are FREE, and you are welcome to try them out

Ask me about Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Ichimoku Clouds or frankly any indicator…and I can tell you the exact nuts and bolts of what make them work…and what makes them fail at times. 90% of traders use them…including me long ago. But if these tools were so clear and concise in their signals to market participants…why do we keep seeing 90% of traders fail over time using them? Why don’t we see more millionaires?

To be clear, the previously mentioned tools can be beneficial…but it is essential as a trader to step back, and recognize when the tools are FAILING you. Take money off the table. Regardless…I asked myself “what are the 10% doing differently”. The answer varies widely amongst those successful traders… but one aspect was for sure: none of them were using the indicators 90% of failing retail were. So, like them, I built my own system and tools. Yes…there were many furious nights with ChatGPT to get my Pinescript code correct. But alas, here we are.

These all have been publicly tested and used, with overwhelming positive responses. You are welcome to them. I’ll keep the explanations simple, and note the descriptions are not all inclusive. But if you have questions about the technical aspects or even want the code itself, ping me in the chat, and ill be happy to share.

Heikin Ashi + Minervini Rules

There are so many successful traders out there…why recreate the wheel…when you can just take your favorite aspects or strategies of great traders, and apply them to your own. This is exactly what the Heikin Ashi + Minervini rules does. If you are unaware, Mark Minervini is a 2 time U.S. Investing Champion, one of the very few traders I look up to. And about 70% of my strategy is based on his.

Ensures price action is above 150 and 200 day moving averages

Why buy when price action is trending down? This is fighting trend.

Ensures 150 moving average is over 200 day moving average

Most of your big pumps, the stock has already been trending upwards, quietly

Price action breaks the prior 3 day average

Your stock cannot be entering into a new trend if it is break the last couple days of price action. We are not trying to time bottoms, but trying to catch a wave that is already forming.

VIX is calm

You will only get signals from this in relatively calm markets. High volatility whiplashes traders….both bulls and bears (think of April 9th as an example). This indicator produces signals below a VIX of 22.

You can access this indicator here: https://www.tradingview.com/script/IR22tMwi-Combined-Minervini-Heikin-Ashi-Signals/

Market Cap Move Estimator

This one is not an indicator but more so a tool. But…why is a 3% move a big deal for SPY…but meaningless on a small cap like JD? Well that is because the market caps are completely different. It takes far less money to move a smaller cap stock, and thus the percent change can be far greater. This tool, you input the market cap. If the price action is above, or below, that indicates that something institutional is going on.

Here is an example, we will use United Health Care (UNH). UNH has a market cap of $543B. Note, you will have to update the market cap size periodically. We go ahead and put that number in (these are in billions)

Now this tool is built to be observed on the 4 hour chart. The top red line is a “big up move”, relative to its current market cap. The top blue line is “average day up move”, the blue line beneath that is a “average day down move” and the bottom red line is a “big down move”. When price action breaks the top red line, its a good signal that institutions are dumping money in…not just changing price action, but changing the market cap of the company’s ticker.

This is more of an initial clue…not something you necessarily buy off of…but its great for putting tickers on your watch list…because the market cap’s are clearly changing!

You can access this tool here: https://www.tradingview.com/script/CdLszxkv-Tim-s-Market-Cap-Move-Estimator/

Multi-Timeframe Highs/Lows

How do you reach a 52 week high? Simple… you will have had to made a 52 day high first. How do you reach a 52 day high? Simple…you will have had to made a 52 4-hour high first. And so on, all the way down to the minute.

Some of you may have traded Affirm (AFRM) with me…one of the best positions we had. Every day I get asked “can we buy Affirm again”. NO. Right now it is making “52” lows on smaller time frames. We want things already trending upwards.

In this chart, you see that the first signal came in September, where the 52 5-minute high, was pushing upwards, and was pushing upwards on the 52 1-hour high. Took some time, but that eventually went on to push the 4-hour, day and weekly highs. Again…not timing the bottom…but recognizing that trend was shifting and new timeframe highs were being made. You cannot be making fresh 52 week lows…and be profitable. Period.

If you would like access to this tool, you can find it here: https://www.tradingview.com/v/psJIvzS1/

Minervini Rules

Here is a pinescript that has all of Mark Minervini’s rules…plus a few of my own. You can get multiple signals from this…so you want to target the first green signal. This is used to target high performance pumpers. Normally you can get at least a few days of a win from this. If you have more questions, ask in the chat.

https://www.tradingview.com/v/D62aWpQ5/

Other Stuff

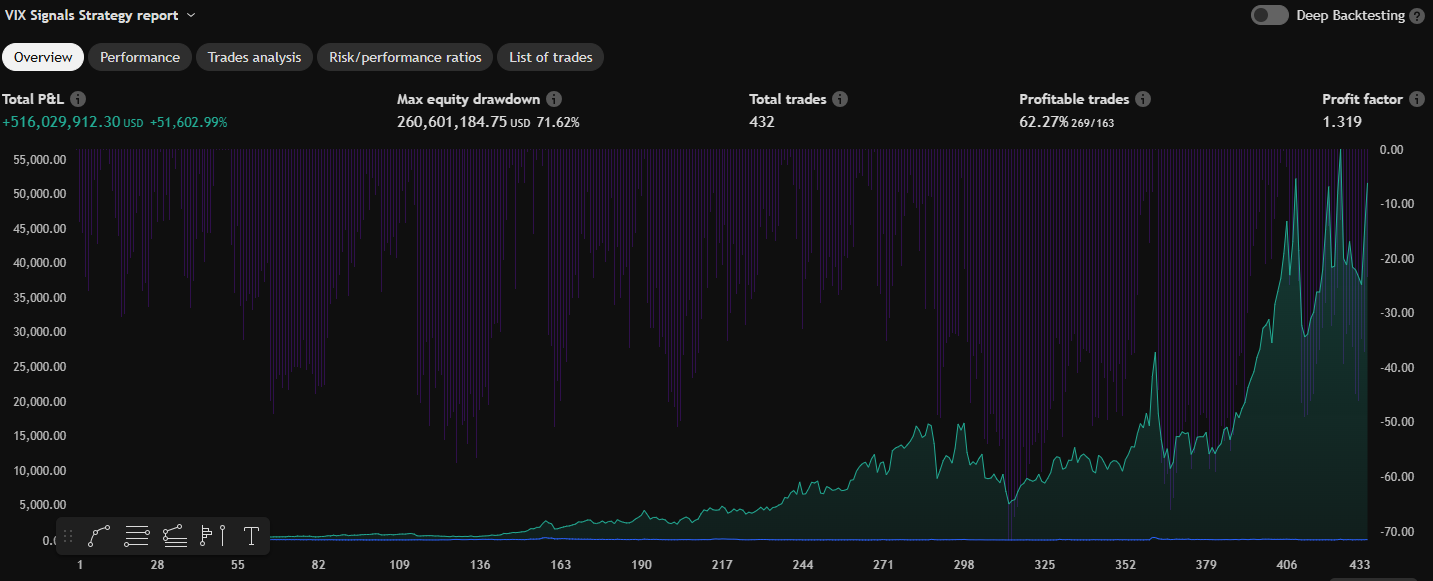

I’ve built several other tools… a VIX trading strategy that appears, at least on paper, to perform extremely well….though I and most people do not trade the VIX. If you would like that, ping me in the chat. The returns are making me contemplate opening another brokerage…because I’ve never seen back test results produce a 51,602% gain….I currently have 1 member tinkering with it. So this may evolve in time.

We also have a screener I built with Python and pulls data from Polygon.io. It scans 4950 tickers everyday, and identifies which stocks have had a pivot in price action upwards. This script I won’t share publicly, simply because there are some vultures out there that want to take it and sell it. But I do provide the signals to the group, and then visually review the few remaining. This provides ease in finding stocks of interest…so we don’t miss any new names starting a trend up. Its the absolutely coolest tool and has helped a lot finding winners.

One last caveat before we part for the day. There is NO PERFECT indicator. Including mine. These are tools to improve your probability of success. Always manage risk. We have seen great results from these tools, but nothing is ever guaranteed. We advocate stops and risk management for a reason.

As always, questions are welcome in the chat. Hope these help you in your investment journey!

Thanks for stopping by!